W-8BEN-E: Explaining the Complex Trust Status

On the list of entity types in Form W-8BEN-E, next to 'Simple Trust,' is its 'older brother'—'Complex Trust.' While both are trusts, their classification and, consequently, the form completion path differ significantly.

Understanding these differences is key to correctly declaring your status. This guide will explain what a complex trust is and how choosing it affects the next steps.

What is a Complex Trust?

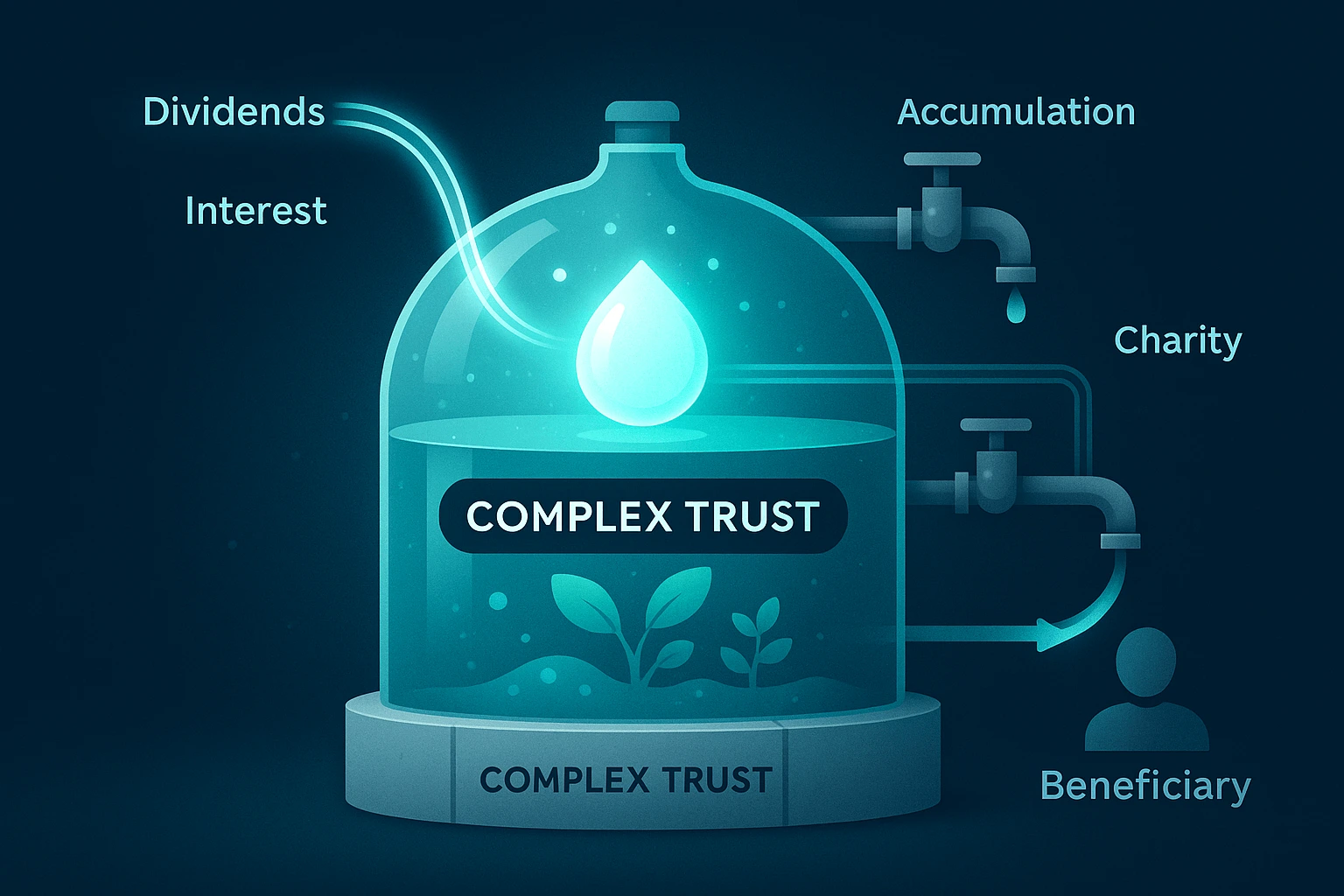

The definition of a complex trust is quite simple: it is any trust that is not a simple trust. This means the founding documents of a complex trust allow it to perform one or more of the following actions:

- Accumulate income: Unlike a simple trust, it is not required to distribute all of its income to beneficiaries annually. It can retain and reinvest profits.

- Make charitable contributions: It has the right to make donations to charitable organizations.

- Distribute principal: It can distribute not only income but also a portion of the trust's principal assets (corpus).

Analogy: If a Simple Trust is a transparent financial channel that instantly passes the entire flow through, a Complex Trust is a managed reservoir. It can accumulate assets, 'grow' them, and distribute them according to complex rules and at different times.

Before selecting this status, you must obtain confirmation from a lawyer that your organization meets this specific classification.

The Main Path for a Complex Trust on Form W-8BEN-E

The completion path for a complex trust differs from that of a simple trust, especially regarding the choice of FATCA status.

Step 1: Choose Chapter 3 Status

In Part I, Line 4, you check the box for 'Complex trust.' Important difference: Unlike a simple trust, this choice does not require you to answer the hybrid status question in Line 5.

Step 2: Determine FATCA Status (Most Likely Passive NFFE)

Your next step is Part I, Line 5, where you need to choose the status for FATCA purposes. Since trusts typically hold investment assets that generate passive income (dividends, interest, royalties), the most likely status for a complex trust will be 'Passive NFFE' (Passive Non-Financial Foreign Entity).

Step 3: Complete Part XXVI and Possibly Part XXIX

Choosing the 'Passive NFFE' status has important consequences: You are required to complete Part XXVI. In this section, you will have to certify whether your trust has 'substantial U.S. owners.' If such owners exist, you will need to provide their details in Part XXIX.

Claim of Tax Treaty Benefits (Part III)

Like any other foreign entity, a complex trust can claim tax treaty benefits by completing Part III. This is especially relevant if the trust receives income in the form of dividends or royalties from the U.S., as the treaty can significantly reduce the withholding tax rate.

Conclusion

The path for a complex trust on Form W-8BEN-E usually looks like this: Complex Trust (Part I, Line 4) → Passive NFFE (Part I, Line 5) → Complete Part XXVI (and possibly Part XXIX). This fundamentally distinguishes it from a simple trust and requires the disclosure of information about U.S. owners.

Understanding these nuances can be difficult.

Our online builder is designed to ease this process. It will automatically guide you to the required sections after you select your status, helping you avoid errors and fill out the form correctly.

Try our W-8BEN-E Generator