W-8BEN-E for Partnerships: Status and Instructions

Form W-8BEN-E provides clear instructions for foreign partnerships that receive income from U.S. sources. Correctly identifying your partnership's status is a fundamental step to apply tax rules correctly and avoid the maximum 30% withholding tax.

This guide explains who qualifies as a "Partnership" in the context of U.S. tax law (Chapter 3) and provides step-by-step instructions for completing the relevant sections of Form W-8BEN-E.

Who Qualifies as a 'Partnership'?

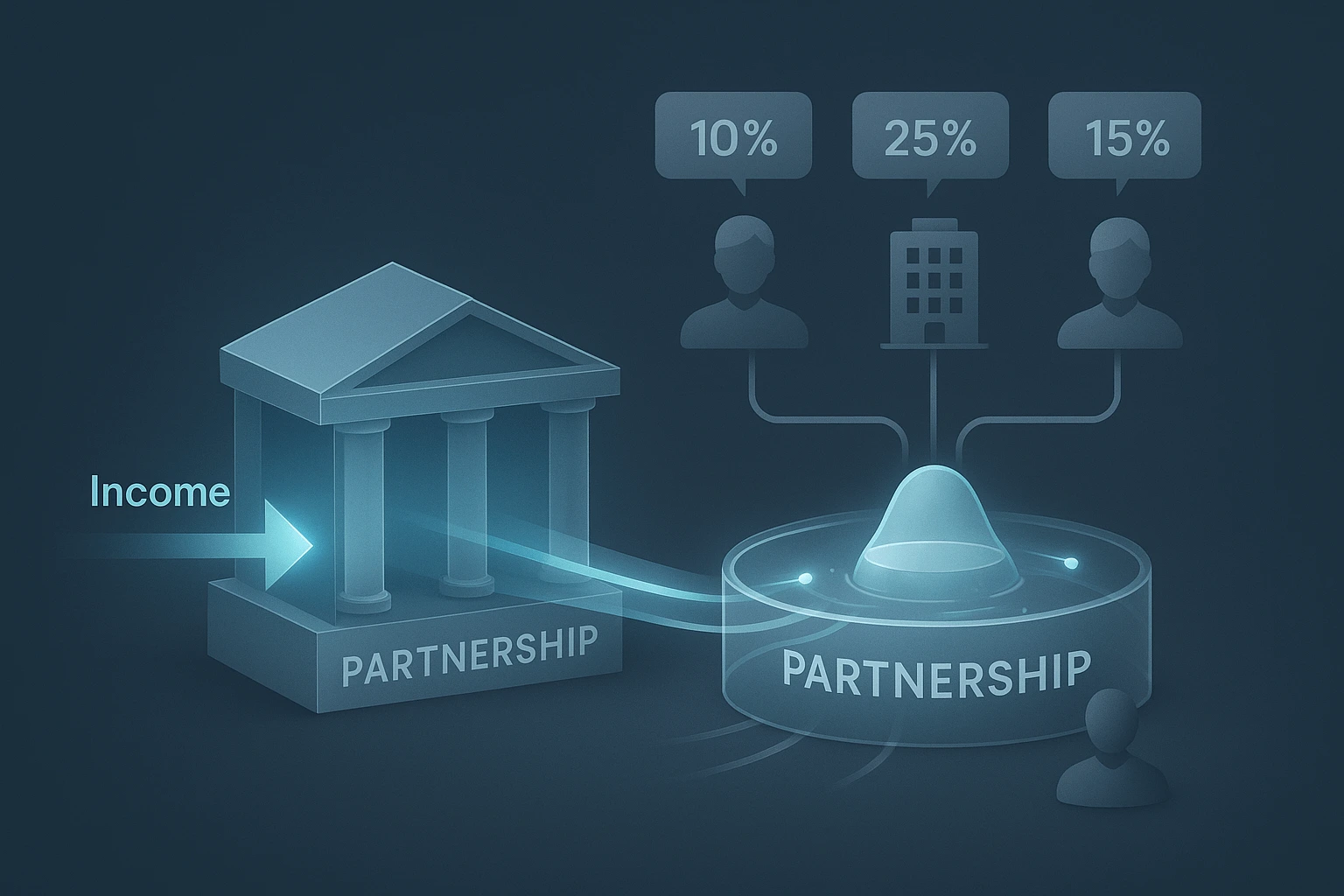

For U.S. tax purposes, a 'Partnership' is a foreign entity that is not a corporation under U.S. rules and has two or more members. A key feature of a partnership is its 'pass-through' tax status. The partnership itself is not the ultimate beneficial owner of the income. Instead, income 'passes through' it to the partners, who bear the tax burden.

- Nonwithholding Foreign Partnership: The standard type of partnership that does not undertake to withhold U.S. tax for its partners. The U.S. withholding agent 'looks through' such a partnership and applies tax rates corresponding to the status of each individual partner.

- Withholding Foreign Partnership (WFP): A partnership that has entered into a special agreement with the U.S. Internal Revenue Service (IRS) and assumes responsibility for withholding taxes on income distributed among its partners. This status is less common and requires complex compliance procedures.

Form W-8BEN-E distinguishes between two main types of foreign partnerships:

Step-by-Step Path for a Partnership on Form W-8BEN-E

For a foreign partnership, the form-filling process is logical and leads to specific sections designed for it.

Step 1: Choose Chapter 3 Status

In Part I, Line 4, you check the box for 'Partnership.' This is the primary identification of your organization. If you have the rare WFP status, you select 'Withholding foreign partnership.'

Step 2: Choose the Corresponding FATCA Status in Chapter 4

Next, in Part I, Line 5, you must choose a status for FATCA purposes. For most non-financial partnerships, the choice will be between two main options: Active Non-Financial Foreign Entity (Active NFFE) if your partnership is an active business, or Passive Non-Financial Foreign Entity (Passive NFFE) if more than 50% of your income is passive. This choice automatically requires you to complete the corresponding section of the form (Part XXV for Active NFFE or Part XXVI for Passive NFFE).

Step 3: Complete Part IV

If in Step 1 you chose the 'Partnership' status (not WFP), you must complete Part IV — 'Nonwithholding Foreign Partnership.' In this section, you certify that you are a nonwithholding foreign partnership and that the income is not 'effectively connected' with a U.S. trade or business. Additionally, you can provide a 'withholding statement' detailing the income distribution among partners and attach W-8 forms from each of them so they can apply their individual tax benefits.

Claim of Tax Treaty Benefits (Part III)

Although choosing the 'Partnership' status does not force you to complete Part III via the hybrid question, you should still do so to claim reduced tax rates under the tax treaty between your country and the U.S. This is particularly relevant if you receive income in the form of dividends or royalties. In Part III, Line 14b, there are options created specifically for partnerships, such as 'Company that meets the ownership and base erosion test.'

The path for a foreign partnership on Form W-8BEN-E is clear: choosing the 'Partnership' status in Chapter 3 leads to choosing an NFFE status in Chapter 4 and requires completing Part IV. The key is understanding the 'pass-through' nature of your structure and being prepared to provide information about the ultimate beneficiaries (partners) to avoid maximum tax withholding.

Our intelligent form builder ensures full compliance with the requirements for partnerships. The system will guide you through all necessary steps, including choosing the correct statuses and filling out the relevant parts, so you can confidently generate a correctly filled Form W-8BEN-E.

Try our W-8BEN-E Generator