W-8BEN-E: What is a Disregarded Entity and How to Fill Out the Form

When filling out Form W-8BEN-E, selecting the 'Disregarded Entity' status (which can be translated as 'transparent entity') raises the most questions. What is this status? Who chooses it? And how does it affect the completion of other form fields?

This guide will help you understand this complex concept and correctly reflect your company's structure.

What is a Disregarded Entity?

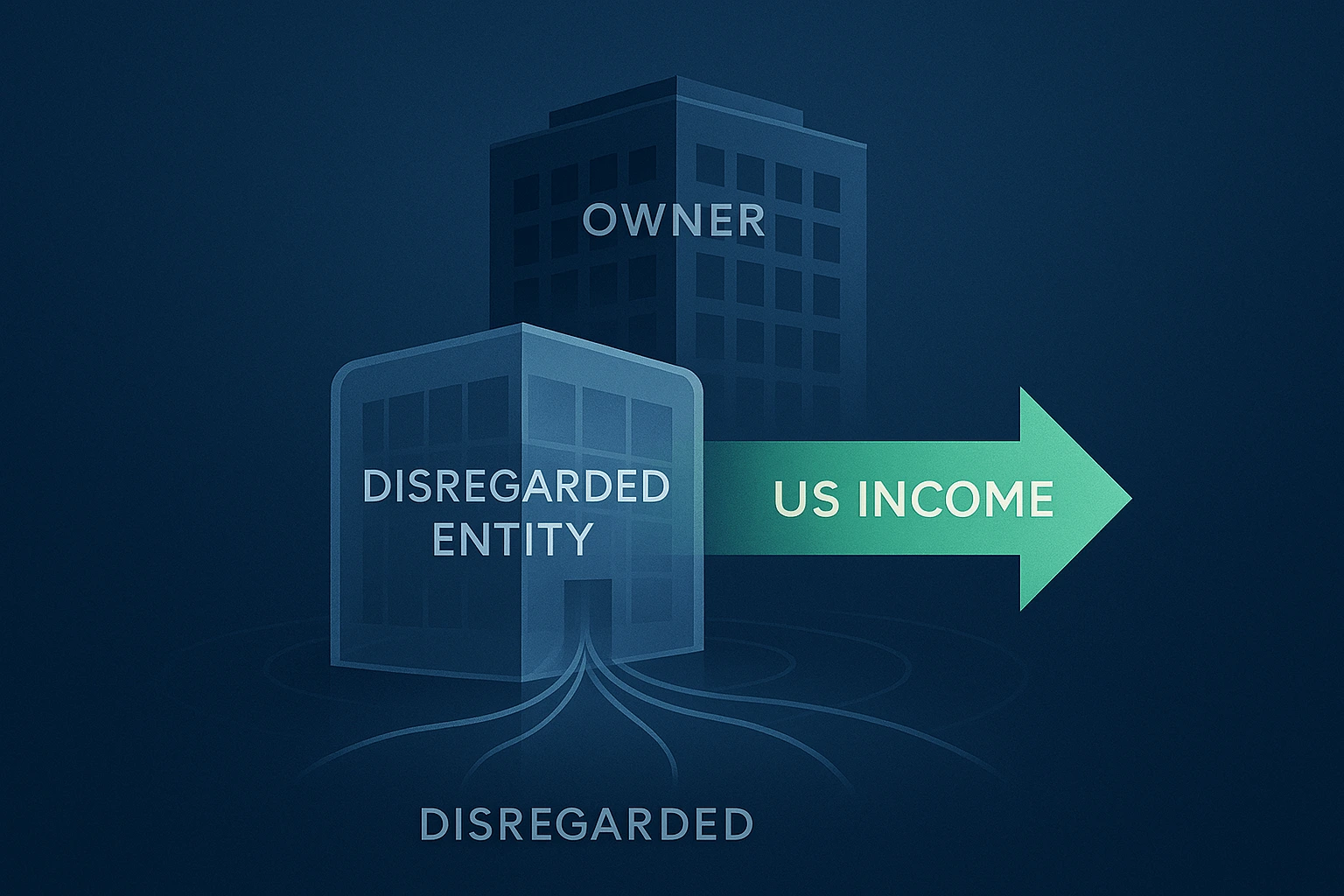

A Disregarded Entity is a legal entity that is separate from its owner but is 'disregarded' or considered 'transparent' for U.S. tax purposes. This means the U.S. Internal Revenue Service (IRS) looks through this structure and attributes all its income and tax status to its sole owner.

- The most common example worldwide is a Single-Member LLC owned by another company.

- Analogy: Imagine a glass box. Legally, the box exists as a separate object. But for the tax authority, it is completely transparent. The IRS looks through it and sees only the one standing behind it—the owner. This box is the 'Disregarded Entity'.

This is a complex legal classification, and you should determine if your entity is a disregarded entity only after consulting with a qualified lawyer.

Two Scenarios for Filling Out the Form: Who's Who?

This is the most crucial aspect. How the form is filled out depends on who owns the disregarded entity.

- Distinguish between the owner and the entity: Form W-8BEN-E is always filled out on behalf of the ultimate beneficial owner of the income. You must enter their name in Line 1, their status in Line 4, and the name of the disregarded entity receiving the payment in Line 3.

Scenario A (Most Common): The owner is a legal entity (e.g., a corporation)

In this case, the form is filled out on behalf of the owner, as they are the ultimate beneficial owner of the income. Part I, Line 1: Enter the name of the owner company. Part I, Line 3: Enter the name of the disregarded entity that actually receives the payment. Part I, Line 4: Select the status of the owner company, for example, 'Corporation'.

In this scenario, you do NOT select 'Disregarded entity' in Line 4, because this line describes the status of the beneficial owner (your main company), not the subdivision.

Scenario B (Rare): The owner is a 'transparent' structure (e.g., a trust)

If the beneficial owner itself, indicated in Line 1, is a structure that is considered 'transparent' (e.g., a grantor trust), then the 'Disregarded entity' status can be selected in Line 4. This case is complex and requires professional consultation.

Mandatory Steps and Related Sections

Specifying a 'Disregarded Entity' on the form activates several important dependencies, such as the hybrid status question (Part I, Line 5). Part II 'Disregarded Entity or Branch Receiving Payment' is only filled out if your disregarded entity (named in Line 3) has its own Global Intermediary Identification Number (GIIN).

Key Takeaway

This structure may seem complicated, but our online builder is designed to handle it correctly. It will help you enter all the data correctly and guide you to fill out related sections if necessary.